Acquisitions

Build your SFR portfolio with Roofstock’s expert buy-box analysis, off-market sourcing, underwriting technology, and executional support.

3B

Acquisitions volume

5T

SFR opportunity (US)*

14M

SFR homes (US)*

10M

SFR owners (US)*

Why Roofstock

Roofstock Platform

Roofstock is a data, analytics, and investment platform focused on the single-family rental sector (SFR). Our real estate investing as a service model allows investors of all sizes to leverage on-demand technology and services to acquire, manage, and sell rental properties at scale with more precision, speed, and efficiency than traditional methods.

Investment Solutions

Roofstock’s Capital Management team offers institutional investors multiple ways to access the SFR asset class.

Investors can structure a separately managed account or consider deploying capital directly into available Roofstock-managed funds to pursue a desired strategy.

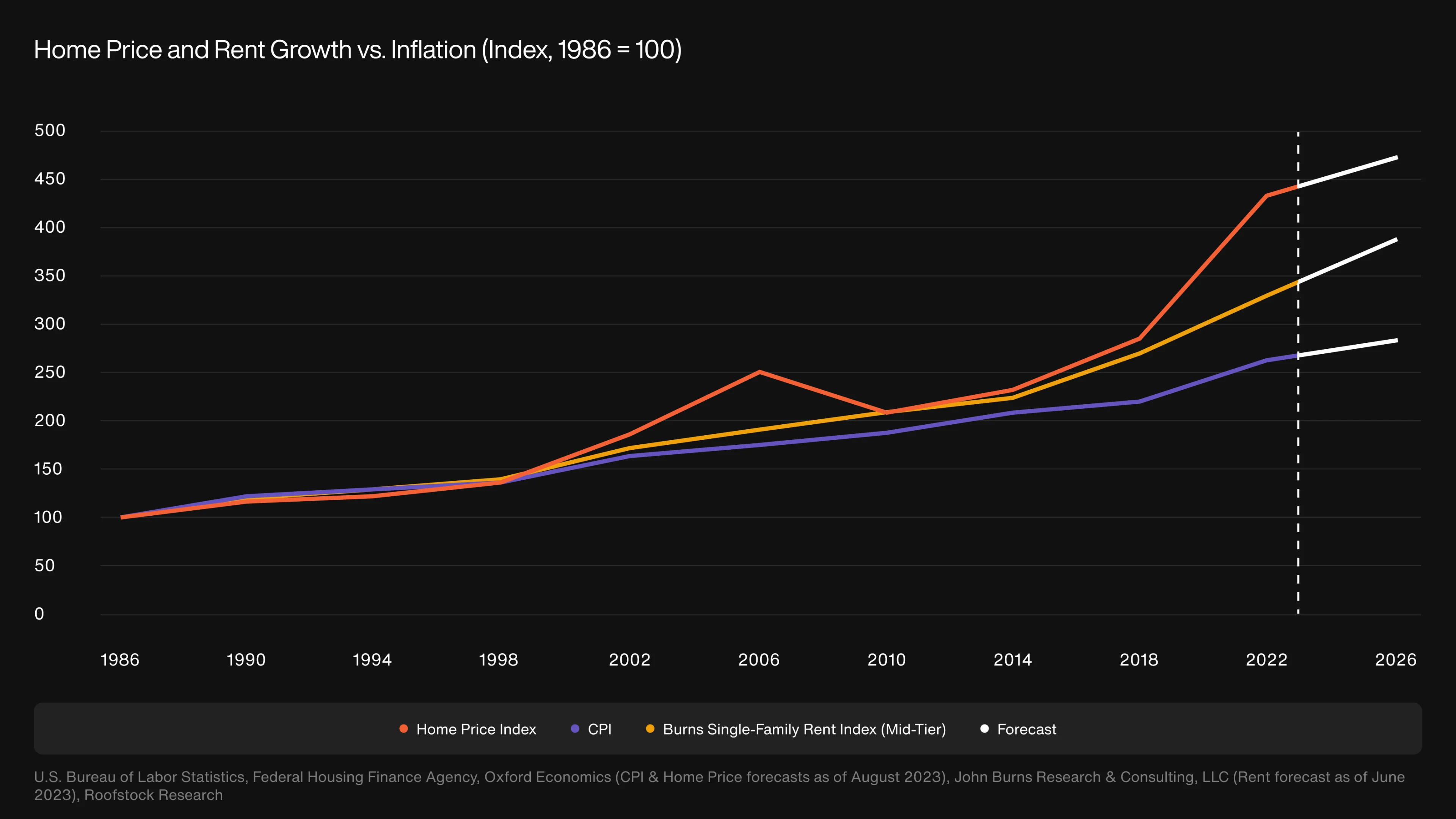

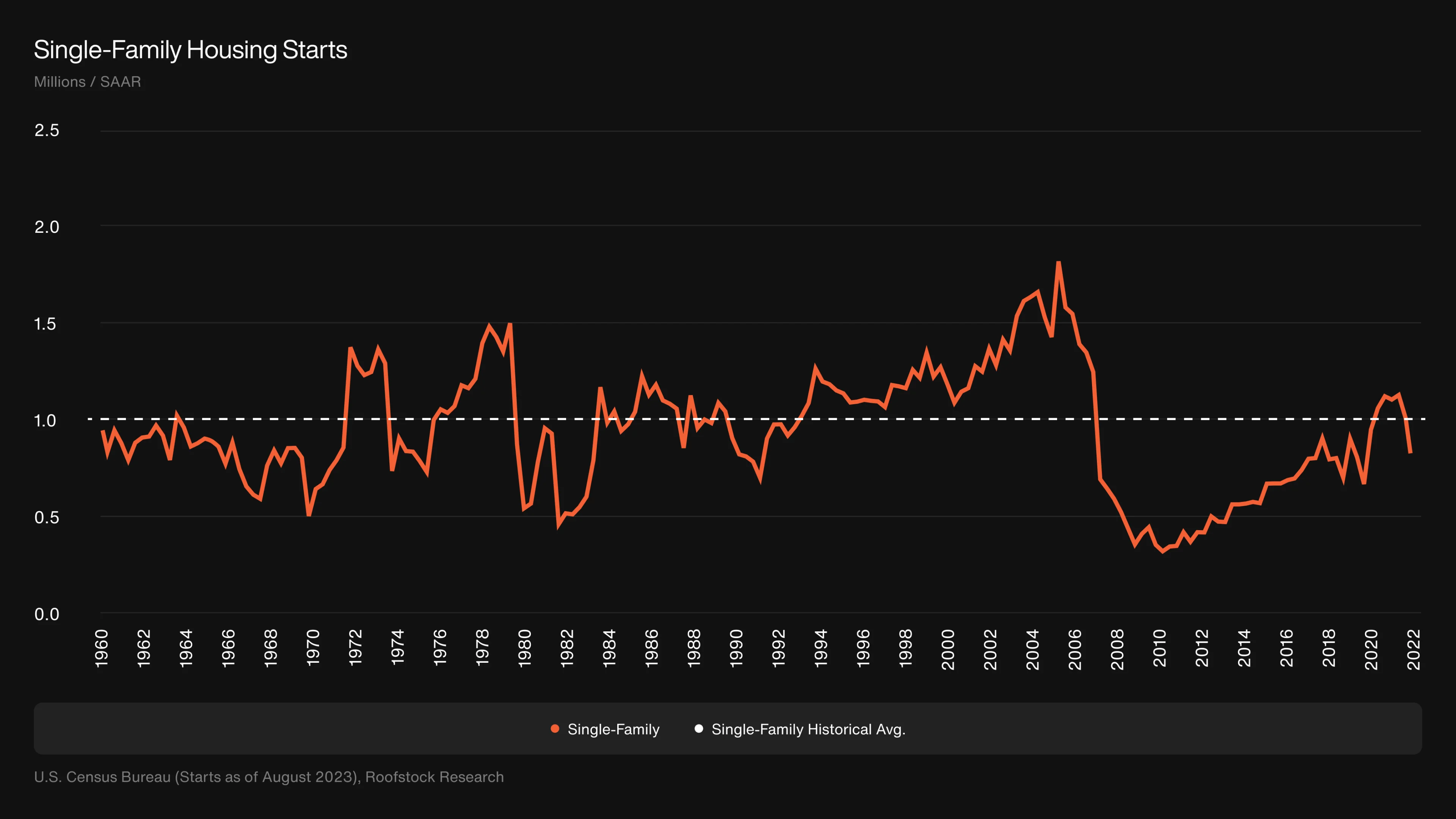

Single-Family Rentals

*Based on Roofstock proprietary data and analysis of U.S. Census Bureau data (November 2023).