The question may not be when will the residential real estate market become more investable — but instead, how can investors adapt to the market that exists today?

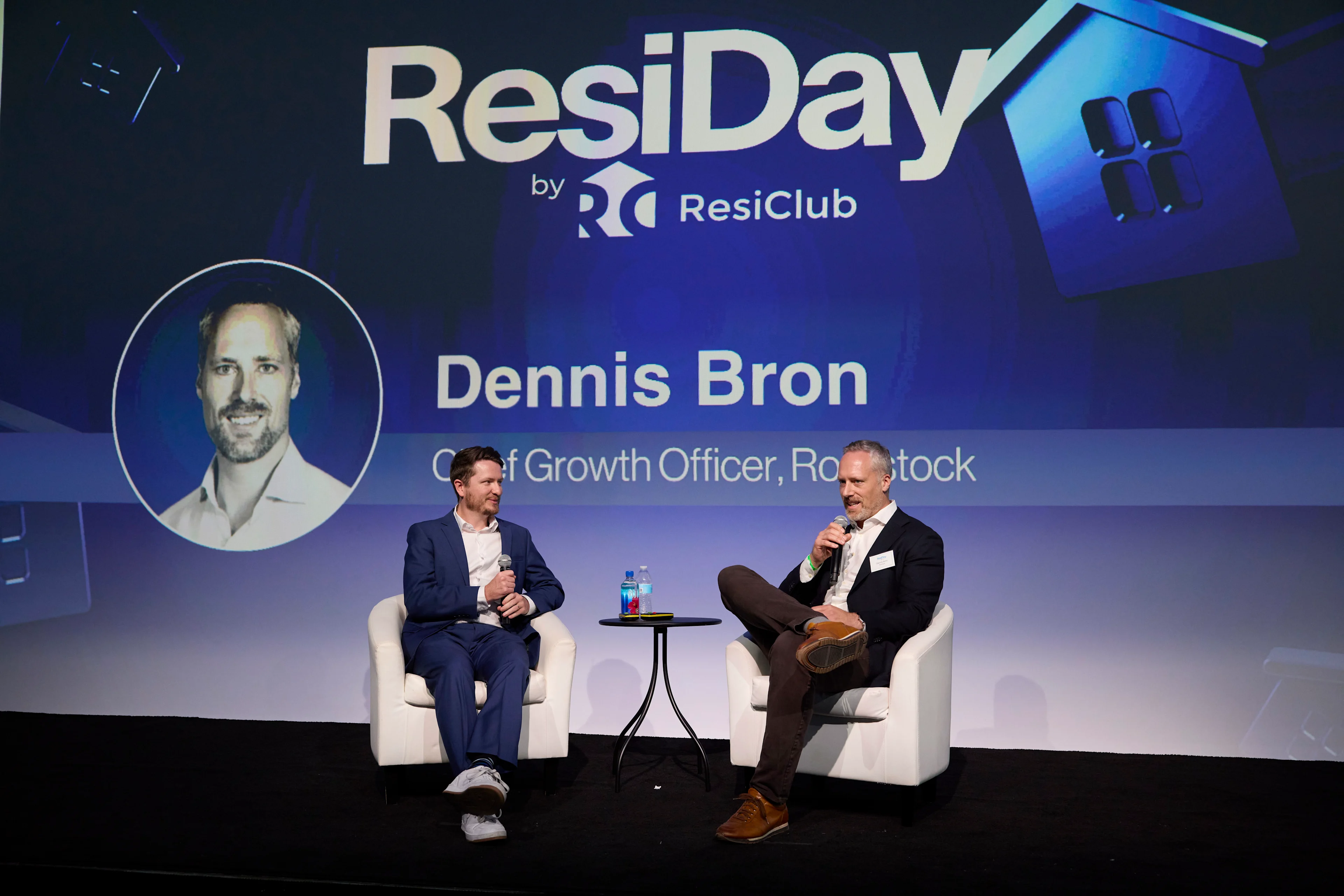

Last week at ResiDay 2025, Roofstock’s Chief Growth Officer Dennis Bron joined Lance Lambert to discuss the current housing landscape and what matters most for investors navigating a market where traditional cycle-timing is no longer an obvious factor. Their conversation highlighted three themes: disciplined portfolio management, strategic flexibility, and the continued steady performance of single-family rentals.

1. Discipline during uncertainty is a competitive advantage

Rather than waiting for volatility to resolve, experienced investors are focusing on improving the performance of the assets they already hold. This means:

Strengthening operational efficiency and yield performance

Consider multiple channels for best execution when exiting

Grounding decisions in granular data analysis and market intelligence rather than headlines

This approach is not limited to large institutions. Mom-and-pop, institutional, and just about every type of investor in between can apply a similar level of rigor.

Our new investment property marketplace supports this by enabling investors to source, compare, and underwrite opportunities aligned with their preferred investing approach — whether it’s focused on cash flow, appreciation, or long-term value creation. The advanced filters and underwriting tools built into the marketplace are designed to bring institutional-grade clarity to investment decisions at every scale.

2. Strategy should align with how markets evolve — not how they once behaved

Markets rarely move in a single direction; they transition.

Conditions in a city like Tampa, for example, have likely not “peaked” — they are merely shifting. As population mobility increases, some properties may now be better suited for short-term rentals, while tertiary markets such as Oklahoma City and Kansas City are drawing attention for being less saturated and offering strong long-term yield performance as traditional rentals.

The investor advantage lies in maintaining optionality and adapting as local dynamics evolve.

Roofstock enables investors to evaluate and operate in flexible ways, with long-term property management available through our Mynd platform, and short-term management available through Roofstock (operating as a Casago franchisee).

3. Single-family rentals continue to demonstrate durable performance

As the single-family rental asset class has matured, it has shown resilience across interest-rate environments and regional demand shifts. Well-managed portfolios exhibit:

High and stable occupancy

Persistent rental demand supported by demographic trends

Predictable yield performance driven by operational controls

For investors with longer-term investment horizons, SFR offers:

Reliable, recurring income

Long-term value creation through thoughtful asset selection and management

Flexibility to evolve strategies as neighborhoods and tenant needs change

On the demand side, the single-family-rental asset class expands housing mobility and choice by providing high-quality rental options across various life stages and geographies.